JPM Sustainability A Deep Dive

JPM sustainability isn’t just a buzzword; it’s a multifaceted strategy shaping JPMorgan Chase’s operations and influencing the broader financial landscape. This exploration delves into their ambitious goals, innovative initiatives, and the measurable impact they’re striving to achieve across environmental, social, and governance (ESG) factors. We’ll examine their reporting transparency, the challenges they face, and the potential for future growth in their sustainability journey.

From detailed analyses of their sustainability reports to comparisons with industry competitors, we’ll uncover how JPMorgan Chase is navigating the complexities of sustainable finance and its role in fostering a more responsible global economy. We’ll also consider both the positive and negative consequences of their actions, providing a balanced and comprehensive view.

JPMorgan Chase & Co.’s Sustainability Initiatives: Jpm Sustainability

Source: com.hk

JPMorgan Chase & Co. has publicly committed to a comprehensive sustainability strategy, aiming to integrate environmental, social, and governance (ESG) factors into its business operations and investment decisions. Their efforts span various aspects of their operations, from financing sustainable projects to reducing their environmental footprint. This commitment is reflected in their ambitious goals and targets, detailed below.

JPMorgan Chase’s Sustainability Goals and Targets

JPMorgan Chase has set several ambitious goals across various ESG areas. These include a commitment to finance and facilitate $2.5 trillion in green initiatives by 2030. This encompasses renewable energy, sustainable transportation, and energy efficiency projects. They also aim to achieve net-zero greenhouse gas emissions across their operations by 2050. This involves significant reductions in their own energy consumption and carbon footprint, and supporting clients’ transitions to low-carbon economies. Furthermore, they have targets related to social equity, including increasing diversity and inclusion within their workforce and promoting economic empowerment in underserved communities. These goals are regularly reviewed and updated to reflect evolving best practices and global sustainability challenges.

Specific Programs and Initiatives

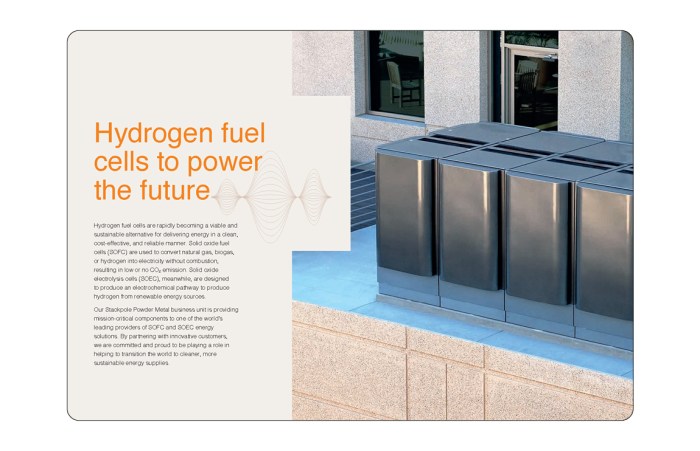

JPMorgan Chase’s sustainability initiatives are implemented across various business segments. In their financing arm, they provide significant capital for renewable energy projects globally, including wind farms and solar power plants. Their investment banking division advises companies on sustainable business practices and assists them in issuing green bonds. Internally, they’ve implemented energy efficiency measures across their offices, reducing energy consumption and waste. They also engage in community development initiatives, supporting programs that promote financial inclusion and sustainable economic growth in underserved communities. For example, they have invested in affordable housing projects and initiatives focused on small business development in low-income areas.

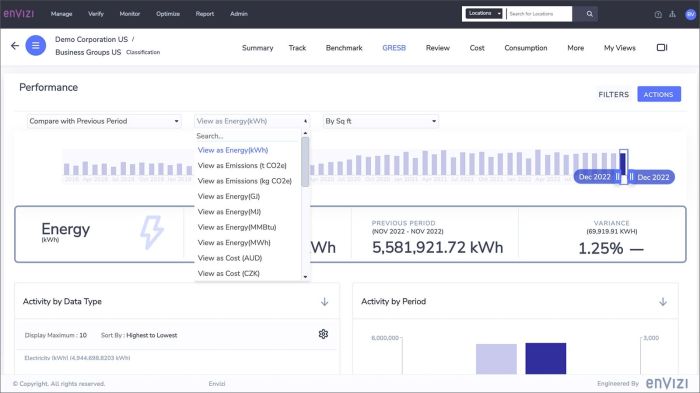

Measuring and Reporting ESG Performance, Jpm sustainability

JPMorgan Chase utilizes a robust framework for measuring and reporting its ESG performance. They conduct regular assessments of their environmental impact, analyzing metrics such as greenhouse gas emissions, water usage, and waste generation. Their social impact is measured through metrics related to diversity and inclusion within the workforce, community investment, and client engagement. Governance practices are evaluated based on board diversity, risk management, and ethical conduct. They publish an annual Sustainability Report, detailing their progress towards their goals and targets, providing transparency on their performance and areas for improvement. This report adheres to widely accepted ESG reporting standards, ensuring comparability with other financial institutions.

Comparison with Key Competitors

| Bank | Renewable Energy Financing (USD Billions) | Net-Zero Commitment Year | ESG Reporting Framework |

|---|---|---|---|

| JPMorgan Chase | $2.5 trillion (target by 2030) | 2050 | GRI, SASB |

| Bank of America | $1 trillion (target) | 2050 | GRI, SASB |

| Citigroup | $1 trillion (target) | 2050 | GRI, TCFD |

| Wells Fargo | Significant investments (specific figures vary) | 2050 | GRI, SASB |

*(Note: Data is subject to change and may represent targets rather than fully realized achievements. Consult individual bank reports for the most up-to-date information.)*

JPMorgan Chase’s Sustainability Reporting and Transparency

Source: jpmorganchase.com

JPMorgan Chase’s commitment to sustainability extends beyond its initiatives; it also encompasses robust reporting and transparency to ensure accountability and stakeholder engagement. Their reporting aims to provide a clear picture of their environmental, social, and governance (ESG) performance, allowing investors, customers, and employees to assess their progress and impact. This involves detailed data collection, verification processes, and clear communication strategies.

JPMorgan Chase employs a multi-faceted approach to collecting and verifying data related to its sustainability performance. This includes internal data collection from various business units, utilizing existing operational systems and databases. They also leverage external data sources and third-party assurance providers to ensure the accuracy and reliability of their reported information. For example, greenhouse gas emissions are calculated using established methodologies like the Greenhouse Gas Protocol, and independent verification is sought for key metrics to enhance credibility. Data quality is maintained through regular audits and reconciliation processes.

Data Collection and Verification Methods

JPMorgan Chase’s data collection and verification methods are designed to ensure accuracy and reliability. They use a combination of internal systems, external data sources, and third-party verification to validate their sustainability performance. Internal data is collected through existing operational systems and databases across various business units. External data sources supplement this information, providing broader context and independent validation. Third-party assurance providers conduct independent reviews of selected data points, further strengthening the credibility of the reporting. This multi-layered approach enhances transparency and reduces the risk of reporting inaccuracies.

Communication of Sustainability Progress

JPMorgan Chase communicates its sustainability progress through various channels, including annual sustainability reports, dedicated sections on their corporate website, and engagement with stakeholders through conferences, investor calls, and employee communications. Their annual reports detail their performance against key sustainability metrics, providing context and explaining their progress toward established goals. The company’s website provides readily accessible information on its sustainability strategy, initiatives, and performance data. Direct engagement with stakeholders allows for two-way communication and facilitates feedback incorporation.

Areas for Improvement in Sustainability Reporting

While JPMorgan Chase’s sustainability reporting is comprehensive, there’s always room for improvement. Enhanced disclosure of the methodology used for calculating specific metrics, particularly those related to social impact, could increase transparency. Greater detail on the materiality assessment process, which identifies the most significant ESG issues for the company, would provide stakeholders with a clearer understanding of the company’s priorities. Finally, increased use of external, standardized frameworks, such as the Task Force on Climate-related Financial Disclosures (TCFD) recommendations, could improve comparability with other financial institutions.

Key Sustainability Performance Metrics

Tracking progress requires clear metrics. JPMorgan Chase uses a range of key indicators to monitor its sustainability performance across environmental, social, and governance dimensions.

- Greenhouse Gas Emissions (Scope 1, 2, and 3): Measures direct and indirect emissions from operations and value chain.

- Renewable Energy Use: Tracks the percentage of electricity sourced from renewable sources.

- Water Consumption: Monitors water usage across operations and assesses water stress risks.

- Financing of Sustainable Activities: Measures the amount of financing allocated to sustainable projects and initiatives.

- Employee Diversity and Inclusion Metrics: Tracks representation of diverse groups within the workforce.

- Community Investment: Measures philanthropic contributions and community engagement efforts.

- Governance Practices: Assesses board diversity, executive compensation, and other governance-related factors.

Impact of JPMorgan Chase’s Sustainability Efforts

Source: amazonaws.com

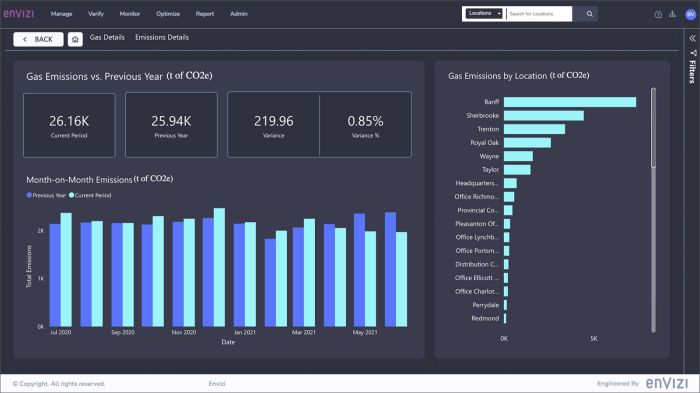

JPMorgan Chase’s sustainability initiatives, while ambitious, have multifaceted impacts, both positive and negative. Understanding these effects is crucial for assessing the long-term viability and societal contribution of their commitment. This section examines the environmental footprint of their operations and financing, the benefits to communities and stakeholders, and a balanced perspective on both the successes and challenges of their approach.

JPMorgan Chase’s environmental impact stems from its operations (energy consumption, waste generation, etc.) and, more significantly, from its financing activities. The bank’s lending and investment decisions influence the environmental performance of numerous industries, from fossil fuels to renewable energy. While they’ve committed to significant reductions in greenhouse gas emissions and increased financing for sustainable projects, the sheer scale of their operations makes complete avoidance of negative environmental impact challenging. For example, continued investment in fossil fuel projects, even alongside investments in renewables, can be viewed as a significant contradiction to their overall sustainability goals. The challenge lies in balancing immediate financial returns with long-term environmental responsibility.

Environmental Impact of JPMorgan Chase’s Operations and Financing

JPMorgan Chase’s commitment to reducing its carbon footprint includes targets for reducing greenhouse gas emissions from its operations and influencing its clients’ emissions. They’ve set ambitious goals, but achieving them requires significant changes across their operations and investment portfolios. For example, their efforts to transition their operations to renewable energy sources are impacting their carbon emissions positively, though the scale of their global operations presents ongoing challenges. Simultaneously, their financing of renewable energy projects and sustainable infrastructure is a substantial contribution towards a lower-carbon economy, but the continued financing of fossil fuel projects remains a point of contention and a potential negative impact. A complete assessment requires considering both sides of this complex equation.

Community and Stakeholder Benefits from JPMorgan Chase’s Sustainability Initiatives

JPMorgan Chase’s sustainability efforts have yielded tangible benefits for various communities and stakeholders. Their investments in affordable housing, for instance, have directly improved living conditions for many families. Furthermore, their support for community development initiatives, including programs focused on workforce development and small business growth, has fostered economic opportunities in underserved areas. These initiatives contribute to social equity and create a positive ripple effect in the communities they serve. For example, their financing of affordable housing projects in low-income urban areas has directly increased access to safe and stable housing, a crucial factor for overall community well-being.

Comparison of Positive and Negative Impacts of JPMorgan Chase’s Sustainability Efforts

Analyzing JPMorgan Chase’s sustainability impact requires a balanced perspective. While their initiatives in renewable energy financing and community development are commendable and have generated demonstrably positive outcomes, the bank’s continued involvement in fossil fuel financing remains a significant source of criticism. This creates a tension between short-term financial gains and long-term environmental sustainability. One could argue that their continued engagement with high-emission industries hinders the overall positive impact of their other sustainability-focused activities. A thorough evaluation must acknowledge both the successes and the shortcomings to foster a more holistic understanding of their influence.

Long-Term Financial Implications of JPMorgan Chase’s Commitment to Sustainability

JPMorgan Chase’s commitment to sustainability carries both risks and opportunities from a financial perspective. While the transition to a low-carbon economy presents challenges, it also offers significant investment opportunities in renewable energy, sustainable infrastructure, and green technologies. Successfully navigating this transition could provide a competitive advantage, attracting investors who prioritize environmental, social, and governance (ESG) factors. However, failing to adequately address climate-related risks, such as stranded assets in fossil fuel investments, could lead to substantial financial losses. The long-term financial health of the company is intrinsically linked to its ability to successfully manage and adapt to the evolving landscape of sustainable finance. Companies like Tesla, demonstrating success in sustainable technologies, showcase the potential for financial rewards from environmentally conscious practices. Conversely, companies struggling to adapt to stricter environmental regulations face significant financial penalties and market devaluation, illustrating the financial risks of inaction.

Challenges and Opportunities in JPMorgan Chase’s Sustainability Strategy

Source: jpmorganchase.com

JPMorgan Chase’s ambitious sustainability goals present both significant challenges and exciting opportunities. Successfully navigating these complexities will require strategic planning, robust implementation, and a commitment to continuous improvement across all aspects of the firm’s operations. This section will explore the key hurdles JPMorgan Chase faces and highlight potential avenues for enhancing its sustainability leadership.

Key Challenges in Achieving Sustainability Goals

Meeting JPMorgan Chase’s sustainability targets requires overcoming several substantial obstacles. These include the inherent complexities of measuring and managing environmental and social impacts across a vast global network, the need for consistent data collection and reporting across diverse business units, and the potential for conflicting priorities between short-term financial gains and long-term sustainability objectives. Furthermore, navigating evolving regulatory landscapes and stakeholder expectations adds another layer of complexity. Successfully addressing these challenges will be crucial to the firm’s long-term success and reputation.

Opportunities to Enhance Sustainability Performance and Leadership

Despite the challenges, JPMorgan Chase possesses significant opportunities to bolster its sustainability performance and solidify its position as a leader in the field. Leveraging its extensive financial resources and global reach, the firm can invest in innovative technologies and sustainable business models, fostering a culture of sustainability throughout its operations. This includes actively supporting and financing sustainable projects, developing and implementing robust carbon reduction strategies, and proactively engaging with stakeholders to ensure transparency and accountability. A commitment to continuous improvement and data-driven decision-making will be key to maximizing these opportunities.

Integrating Sustainability into Core Business Strategies

Effective integration of sustainability considerations into JPMorgan Chase’s core business strategies is paramount. This involves embedding sustainability criteria into investment decisions, loan underwriting processes, and risk management frameworks. By systematically evaluating the environmental and social impacts of its financial activities, the firm can identify and mitigate potential risks while simultaneously unlocking new opportunities in the growing sustainable finance market. This requires a fundamental shift in how business decisions are made, prioritizing long-term value creation alongside short-term financial performance.

Hypothetical Scenario: JPMorgan Chase’s Sustainability Initiatives in the Next Five Years

Imagine a scenario five years from now where JPMorgan Chase has significantly advanced its sustainability initiatives. Through strategic investments in renewable energy projects and green technologies, the firm has reduced its operational carbon footprint by 50%, exceeding its initial targets. Furthermore, JPMorgan Chase has become a leading financier of sustainable infrastructure projects globally, channeling billions of dollars into renewable energy, energy efficiency, and sustainable transportation initiatives. This has not only contributed to positive environmental outcomes but also generated substantial returns for the firm, demonstrating the financial viability of sustainable investments. The firm’s enhanced transparency and robust stakeholder engagement have solidified its reputation as a responsible corporate citizen, attracting both clients and employees committed to sustainability. This success is built upon a comprehensive internal program that fosters a culture of sustainability throughout the organization, incentivizing employees at all levels to integrate sustainability considerations into their daily work. This hypothetical scenario demonstrates the potential for significant progress if JPMorgan Chase fully embraces its sustainability goals and integrates them strategically across all aspects of its operations. The success will depend on consistent commitment, innovative solutions, and a proactive approach to managing risks and opportunities in the evolving sustainability landscape.

JPMorgan Chase’s Role in the Broader Sustainability Landscape

Source: canmakingnews.com

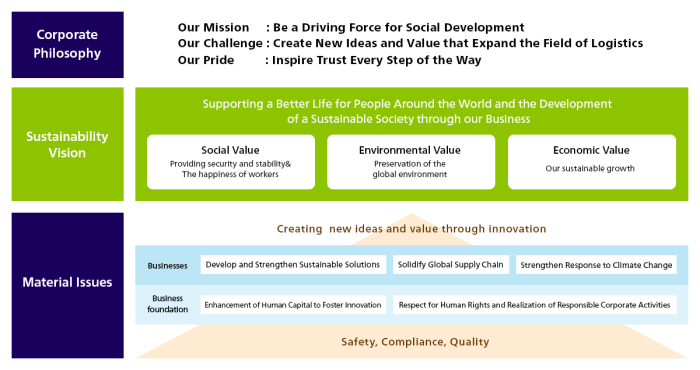

JPMorgan Chase’s influence on the broader sustainability landscape extends beyond its internal initiatives. It actively participates in and shapes industry-wide efforts to promote responsible environmental and social practices, influencing both its clients and the financial services sector as a whole. This multifaceted role demonstrates its commitment to a more sustainable future.

JPMorgan Chase’s engagement with industry initiatives and collaborations is extensive and impactful.

JPMorgan Chase’s Participation in Sustainability Initiatives

JPMorgan Chase is a prominent member of numerous global initiatives focused on sustainability. For example, its participation in the Task Force on Climate-related Financial Disclosures (TCFD) demonstrates its commitment to transparent climate risk reporting. Similarly, its involvement in the UN Principles for Responsible Investment (PRI) reflects its dedication to integrating ESG (Environmental, Social, and Governance) factors into its investment decisions. These memberships provide a platform for collaboration and knowledge sharing with other leading financial institutions, driving collective action towards a more sustainable future. Beyond these, JPMorgan Chase actively participates in various industry consortiums and working groups dedicated to developing and implementing sustainable finance standards and best practices. This collaborative approach allows for the sharing of best practices and the development of standardized frameworks.

Influencing Client Sustainability Practices

JPMorgan Chase leverages its position to influence the sustainability practices of its clients. Through its financing and advisory services, it actively encourages the adoption of sustainable business practices. For instance, it provides financing for renewable energy projects and offers advisory services to help companies reduce their carbon footprint. Furthermore, the bank incorporates ESG factors into its credit risk assessments, incentivizing companies to improve their environmental and social performance. This approach not only helps mitigate risks but also drives positive change within client organizations. A clear example is JPMorgan Chase’s commitment to providing significant financing for renewable energy projects, helping companies transition to cleaner energy sources, and reducing their overall carbon footprint.

Promoting Sustainable Finance and Investment

JPMorgan Chase plays a crucial role in promoting sustainable finance and investment. It offers a range of financial products and services designed to support sustainable development, such as green bonds and sustainable investments. These initiatives help channel capital towards projects and companies committed to environmental and social responsibility. The bank’s commitment to sustainable finance is further demonstrated by its setting of ambitious targets for its operations, and the implementation of robust internal policies and procedures to ensure alignment with these targets. This commitment is not only good for the environment and society but also mitigates financial risks associated with climate change and other ESG factors.

JPMorgan Chase’s Position within the Broader Financial Services Industry

JPMorgan Chase occupies a significant position within the broader financial services industry’s sustainability landscape. Its scale and influence allow it to set a precedent for other institutions, driving broader adoption of sustainable practices. Its public commitments, active participation in industry initiatives, and extensive engagement with clients demonstrate its leadership role. The bank’s substantial investments in sustainable finance and its integration of ESG factors into its core business operations significantly impact the industry’s overall trajectory toward greater sustainability. This leadership position allows JPMorgan Chase to influence the behavior of other financial institutions and promote the widespread adoption of sustainable finance practices. The company’s influence is seen in the growing number of financial institutions adopting similar sustainability initiatives and frameworks.

Final Thoughts

Source: aAmphenolsocapex.com

JPMorgan Chase’s commitment to sustainability, while facing significant hurdles, represents a powerful force in the financial sector. Their ongoing efforts, though imperfect, are pushing the boundaries of responsible investing and corporate citizenship. The journey towards a truly sustainable future requires constant adaptation and innovation, and JPMorgan Chase’s story highlights both the progress made and the considerable work that remains. Ultimately, their success will not only impact their bottom line but also the health of the planet and its people.